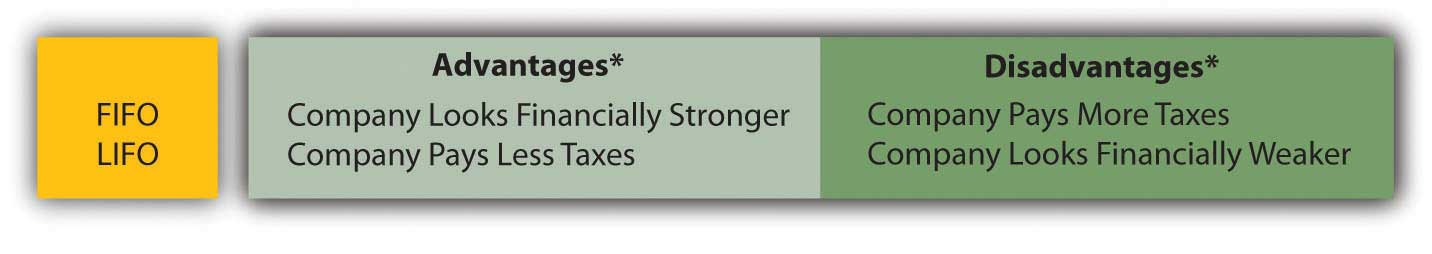

FIFO (First In, First Out), LIFO (Last In, Last Out) and JIT (Just In Time) are three basic inventory methods that companies can use. It is helpful to first understand the advantages of the FIFO inventory method in order to gain a working knowledge of other inventory methods. Choosing between FIFO and LIFO ultimately comes down to financial strategy. When considering which to use, businesses must weigh strategic considerations like financial reporting, tax implications, and compliance with standards.

Advantages of Implementing FIFO in Inventory Management

Higher net income also means higher retained earnings, which can be reinvested into the business or used to pay down debt, further improving cash flow. While FIFO refers to first in, first out, LIFO stands for last in, first out. This method is FIFO flipped around, assuming that the last inventory purchased is the first to be sold. LIFO is a different valuation method that is only legally used by U.S.-based businesses. The company sells an additional 50 items with this remaining inventory of 140 units. The cost of goods sold for 40 of the items is $10 and the entire first order of 100 units has been fully sold.

More complicated than LIFO

This means that you are then faced with more taxes because tax obligations are tied to your business profits. The LIFO cost flow method of inventory reporting is not permitted under the tax laws of many countries, such as the United Kingdom, Australia, and New Zealand. This is because LIFO potentially distorts or artificially lowers a company’s profitability and financial reporting. For this reason, companies must be especially mindful of the bookkeeping under the LIFO method as once early inventory is booked, it may remain on the books untouched for long periods of time. FIFO can be a better indicator of the value for ending inventory because the older items have been used up while the most recently acquired items reflect current market prices.

LIFO Method: Definition, Benefits, Drawbacks, and Applications

The oldest costs will theoretically be priced lower than the most recent inventory purchased at current inflated prices in this situation if FIFO assigns the oldest costs to the cost of goods sold. The FIFO method is equally important in the manufacturing industry, where raw materials and components are crucial for production. Manufacturing businesses often receive materials in batches, and the FIFO principle ensures that the oldest batch is consumed first. By using older inventory first, manufacturers can prevent material waste, reduce inventory holding costs, and maintain quality within their production processes. For instance, a manufacturing company can use the FIFO method to determine the cost of raw materials used in production.

Improved forecasting of customer demand

This will give them their FIFO unit cost per item, which they can then use to calculate the COGS and value of their remaining inventory. Businesses in industries with rising costs or prices typically use the LIFO method. This includes companies dealing with commodities, such as oil and gas firms, or those with inventory that doesn’t deteriorate, like metal or chemical producers. LIFO can offer tax benefits when prices are rising by showing reduced profits on paper. For instance, during a sharp rise in oil prices, an energy company using FIFO might report artificially high profits as sales are matched with older, cheaper inventory. This discrepancy can result in misleading financial statements that don’t accurately reflect the company’s true financial position or operational challenges.

- In addition, many companies will state that they use the «lower of cost or market» when valuing inventory.

- Using FIFO, you assume the first 1,000 sold cost $1 per unit, and the remaining 500 cost $2 per unit.

- This is often different due to inflation, which causes more recent inventory typically to cost more than older inventory.

- The LIFO cost flow method of inventory reporting is not permitted under the tax laws of many countries, such as the United Kingdom, Australia, and New Zealand.

- Assuming that inflation is constant, the purchase price of the inventory used in production or that is sold at retail was lower than the price of inventory most recently purchased.

- As for how large this FIFO inventory should be, it depends on how many of your fluctuations you want to decouple.

Advantages of the FIFO Method

The inventory item sold is assessed a higher cost of goods sold under LIFO during periods of increasing prices. While the FIFO method has numerous advantages, it is not without its drawbacks. These disadvantages can affect financial reporting, tax liabilities, and suitability for certain industries. Understanding the potential downsides of FIFO is crucial for businesses to make informed decisions about their inventory valuation methods. Below, we delve into the key disadvantages of the FIFO method, highlighting scenarios where it might pose challenges or be less advantageous. The FIFO method is a fundamental approach that operations professionals can adopt to optimize their inventory management processes.

On the other hand, if the warehouse is storing non-perishable products without expiration dates, either system could potentially be used depending on the specific needs of the business. This method assumes that the most recently purchased products should be sold first. This can result in a lower cost of goods sold but a higher inventory value, which can have negative tax implications. There are pros and cons to both systems, and the best choice for a warehouse will depend on a variety of factors. Therefore it is crucial to manage it in a way that minimizes waste and maximizes profits. This system assumes that the oldest items in stock are the first ones to be sold.

Our customers have access to a broad network of industry partnerships, EDI connections, retailer relationships, ERP, and ecommerce integrations. With best-in-class fulfillment software and customizable solutions, we provide hassle-free logistics support to companies of all sizes. Specific inventory tracing is only used when all components attributable to a finished product are known.

They’re crucial for maintaining the accuracy of your FIFO system, catching errors early, and ensuring that your financial reporting reflects reality. Managers, accountants, and business owners benefit from mastering FIFO to optimize inventory systems and financial practices. The average waiting time was identical for both simulations, 49.7 time units.

As a result, LIFO doesn’t provide an accurate or up-to-date value of inventory because the valuation is much lower than inventory items at today’s prices. Also, LIFO is not realistic for many companies because they would 2018 refund cycle chart for tax year 2017 not leave their older inventory sitting idle in stock while using the most recently acquired inventory. Modern inventory management software like Unleashed helps you track inventory in real time, via the cloud.

The FIFO method inventory valuation is commonly used under both International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). Our satisfied customers include small manufacturers and distributors, 3PL providers and Global 1000 companies. A good management system needs to be flexible enough to account for those items that don’t lend themselves to regular FIFO, and for those that need to be rotated out of stock at set intervals.